Today, Dec. 20, 2017, I am beginning to invest in some real estate crowdfunding sites. If you are interested in learning about my mindset towards investing, check out this article. In this post, I will try to determine my game plan for how much total to invest and where I will invest it. Hopefully this will be helpful in giving you a starting to for how to get started with real estate investing.

First, I need to determine what is a proper asset allocation for my particular age. This investment will be made in a taxable account so I may need to take that into consideration in my overall strategy as well. My current age is 28. For sake of this post and to make the numbers easy, let’s use $100,000 as my current invest-able portfolio.

Determining Target Asset Allocation

To determine how much of my overall portfolio I should invest in real estate, I first need to do a little research on what is a good asset allocation mix for my age. To do this, I will research a few different sources and see what they say and then make a decision that I feel good about.

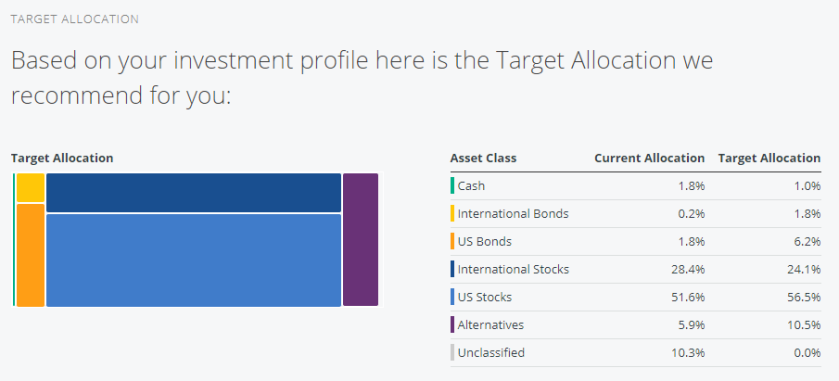

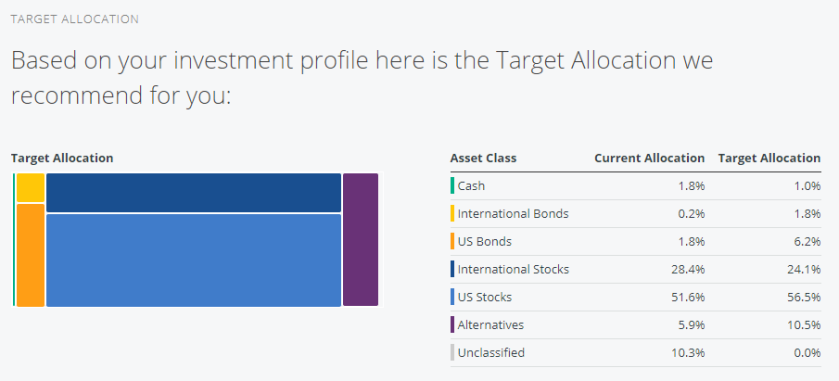

The first place I will check is www.personalcapital.com. To see the data I am showing below you will first need to create an account and sync up all of your banking and investing accounts. Here’s what Personal Capital says my asset allocation should be:

Based on the image above, I currently only have 5.9% of my assets in “Alternatives” but I should have 10.5%. Let’s take a closer look at what percentage of “Alternatives” I have invested in real estate.

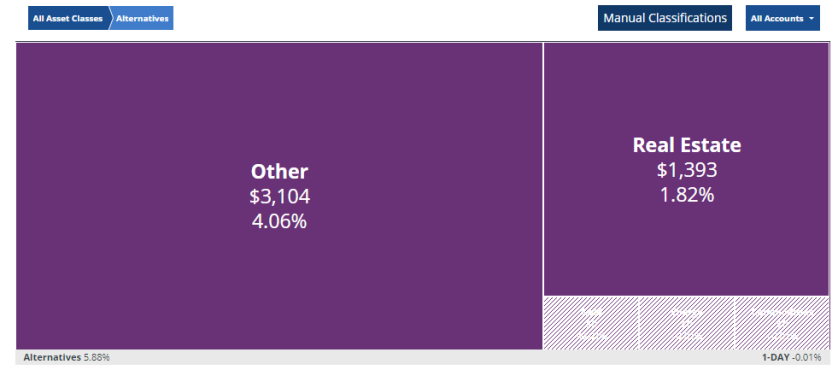

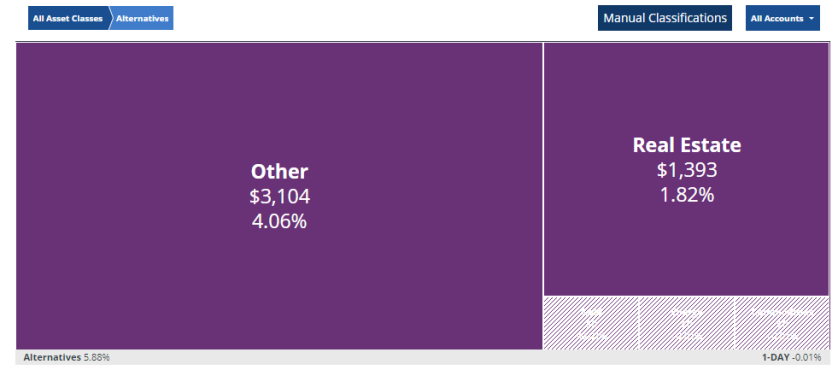

Currently, I only have 1.82% of my portfolio in real estate and 4.06% of my portfolio in “Other”. Looking at this, I’m thinking I definitely have room to add some exposure to real estate. Lets look at some other sources to see what they have to say about how much exposure to real estate I should have in my portfolio.

After some digging, I found that this article (https://www.forbes.com/forbes/2009/0803/real-estate-reit-housing-dividend-property-poor/) says that, based off a study by a Chicago financial research firm called Ibbotson Associates, you should put somewhere between 9-22% of your portfolio into real estate. The same article states that David Swenson, the manager of Yale University’s endowment, advocates putting 20% into real estate. After looking at a few more articles I saw anywhere from 5-30% advocated. Some considerations for real estate investing is that it is typically less liquid than other investments and this should be weighed into your own personal situation. As for me, I feel good about the 10% number so I am going to seek to invest about $10,000 into real estate. Although I already have a little bit of exposure, I’m ok investing a bit more than 10% because I’m so young and therefore have a higher risk tolerance.

Choosing the Investments

With that in mind, I am now ready to begin my investment hunt. First, I have chosen to invest directly into crowd funding real estate investment sites because I can be more diverse this way than owning a single family home or plopping a large sum of money into a multi-family housing complex. Additionally, I can gain more transparency than investing in REITs (real estate investment trusts) on the market and I can get access to tax benefits from depreciation that I couldn’t get in a REIT on the market. Moreover, this approach often allows for better returns because it is closer to the source. I also don’t want this to become another job. From a financial standpoint, the purpose of the businesses I own is to generate cash that I can invest in passive investments to diversify my portfolio because, though businesses can create great cash flow, they are very risky ventures. I continually pull money out of my businesses and move them into a diversified portfolio so that I can capitalize on the growth of the businesses and transition that growth into financial freedom.

To begin choosing my investments, it is important to know that there are many asset classes within real estate. Therefore, it is important to diversify within the real estate asset class itself. Within real estate, there are 4 main investment strategies. In order from conservative to aggressive, these are: core, core plus, value added, and opportunistic. In addition, there are two primary types of investments: debt and equity. Debt is more stable (assuming the debt is properly set up with adequate collateral) and equity is more risky. Debt is also typically more liquid while equity usually requires longer hold times. Lastly, there are many types of real estate properties such as single family homes, apartments, industrial, commercial, land, storage, senior living, etc. All of this needs to be taken into consideration when deciding how to allocate your real estate portfolio.

My First Choice: Put $1,000 into stREITwise: 1st stREIT Office

Leaning on some of research from www.therealestatecrowdfundingreview.com, and their “Quick Quide for the Every-Day, non-accredited Investor,” I have decided to put my first $1,000 dollars into stREITwise: 1st stREIT Office because it has a longer track record than most with an experienced sponsor and it is less risky (though it is a “equity” investment) as it follows a core-plus investment strategy. This eREIT is an office REIT targeting high-quality, stabilized office buildings in undervalued markets across the United States. Their first acquisition was the Panera HQ building in St. Luis, MO. The REIT boasts a solid 10% annual dividend rate with a $1,000 minimum investment. This investment only focuses on office buildings which means I still may want to add exposure to apartments, commercial, and industrial. Another important consideration is the hold time, liquidity, and fees associated with this investment. Let’s take a look.

Hold Time/Liquidity: Your investment is locked up for 1 year. After which, you can withdraw it at the following rates (4-5 years, 97.5%. 3-4 years, 95%. 2-3 years, 92.5%. 1-2 years, 90%).

Fees: Besides the early withdrawal fees, this non-traded REIT has some of the best fees in the industry. According to therealestatecrowdfundingreview.com, “The most important is that there is no performance fee (also called a promote or waterfall). When a fund does well, this is the fee that sucks the most return away from an investor. So that is great to see. All other fees are in line or below average. They are exceptionally good on the acquisition fee, charging none (versus an industry average of 2%). The only place where they are slightly above average is that they charge a 3% fee on deposit (2% average). But this is a minor quibble. Overall the fees are excellent and earns them the “best fees” award for non-accredited investors.”

Disadvantages: One disadvantage to note is that there is no bankruptcy protection. For me, I’m willing to accept that as I know that any investment carries risk. In addition, currently this REIT only has 1 asset, the Panera HQ. That does concern me, but I feel pretty good about Panera and their ability to pay their rent and the sponsor has a long track record with $5.4B in assets under management so I’m comfortable that they know what they’re doing and are able to grow. Lastly, this REIT offers exposure only to office buildings so I will need to add more diversification as I continue to flesh out my investment plan.

For now, I will consider this a $1,000 investment but as I continue my research I may bump this one up. Keep reading to find out.

What Should I Do Next?

Next, I am wanting to invest in a “debt” investment because my first investment was an “equity” investment. In addition, I’d like this investment to be in a fund that adds exposure to commercial and/or apartment buildings. After looking at the current options, I found that the 2 REITs rated best for “debt” are the Realty Mogul: MogulREIT I (unfortunately, however, after checking they raised their minimum investment to $10,000 now so this one is currently out) and the FundRise: Income eREIT. Both of these funds target commercial and apartment buildings.

Highlights of the Fundrise Income eREIT include: 10% annual dividend paid quarterly, and a diverse allocation of properties based on risk and location. The minimum investment is currently $1,000. Another benefit is that it comes with full bankruptcy protection so that’s nice. One downside is that the liquidity is a bit more stringent with a 5-year hold period to withdraw fee-free. Therefore, I have decided to make this my second investment for $1,000.

What’s in my Portfolio now?

In the portfolio now we have:

- Panera HQ in St. Louis, MO (10% Annual Dividend Paid Quarterly invested in Office Buildings with stREITwise

- Several Apartments in multiple major U.S. cities, one construction loan and one acquisition loan, along with a townhome and a condominium (10% Annual Dividend Paid Quarterly with FundRise Income eREIT)

As of now, it appears that I could use some exposure to single family homes, a bit more commercial properties, industrial/warehousing, and senior living).

What to Add Next?

After some research, I landed on CrowdStreet’s Impact Housing REIT and FundRise’s Growth eREIT. Both of these funds are value-add equity plays with preferred returns around 7-8% through annual dividends with more upside available from 16-20% annual IRR (internal rate of return) possible from the sale of the properties. Both target multi-family properties. I like the idea of splitting funds between the two just to be more diverse. CrowdStreet has higher fees and less liquidity but they also have a stronger track record. For example, the sponsor and his team have acquired 72 multi-family properties over the past 10 years, 40 of which have completed their life cycle and the the average returns have been: 48% average annual Net Operating Increase, 8.55% annual cash on cash, and 24.74% IRR. To me, this strong background is worth the extra fees and less liquidity to increase diversification. Both funds have bankruptcy protection (allowing the investors to vote on the new operator if needed). The FundRise Growth eREIT has been dishing out solid 8% annual dividends on a quarterly basis the past 1.5 years (with the exception of one quarter which was much lower) and has a little better liquidity schedule. To see the full details, visit https://fundrise.com/reits/growth-ereit/view. Both funds have a minimum investment of $1,000. As such, I will next allocate $1,000 to each.

Done with Selecting Investments?

At this point, I have $4,000 invested. What am I missing? I currently have exposure primarily to office and multi-family residential encompassing both debt and equity along with core-plus, value-add, and opportunistic investment strategies. If possible, I’d like to get a bit of exposure to the single family housing market as well as things like commercial, industrial, senior living, and warehousing/storage. For these, I may need to look into some publicly traded REIT ETF’s.

After a bit of research, I found an interesting opportunity with American Homeowner Preservation. AHP buys distressed mortgages from banks at sometime pennies on the dollar and works with the homeowner to renegotiate payment terms to avoid foreclosure. They pay investors a 12% annual dividend on a monthly basis and are required to pay out the 12% and all contributed capital before they earn any profit. I decided to give this a shot with a smaller investment of $500 (the min. is just $100) to see how it goes. According to their website, “when AHP operated as an open end hedge fund from late 2011 – late 2013, we returned over 14% annually to investors. Since we converted to issuing closed end funds in late 2013, we have never failed to pay monthly preferred return to investors nor have we been unable to return capital before the scheduled maturity. We intend to pay investors a return of 12% per year on their invested capital.” For a 12% return and a decent track record I’m willing to give it a shot. If it goes well, I may add more funds slowly. Plus, this will give me some exposure to the single family home market (albiet a reverse exposure through preventing foreclosures).

Filling Out the Real Estate Portfolio with Some REITs:

To complete my diversification of my real estate portfolio, I have turned to publicly-traded REITs.

For senior housing, I found the following REITs to be the major players: SNH, HCN. Of the two, SHN looks quite appealing with a current annual dividend yield above 8%.